Silver Price History: A Comprehensive Analysis of Historical Trends

Are you curious about the rise and fall of silver prices throughout history?

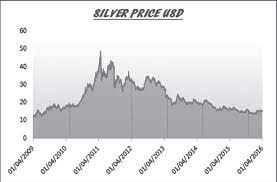

Silver, a precious metal, has a fascinating price history marked by significant fluctuations over the past decades. Its value, often tracked in charts and graphs, reflects a dynamic market influenced by a myriad of factors including supply, demand, inflation, and broader economic trends. Historical data reveals that the price per ounce of silver has seen a varying trend, making it a point of interest for investment analysis.

| Year | Average Closing Price |

Year Open | Year High | Year Low | Year Close | Annual % Change |

|---|---|---|---|---|---|---|

| 2023 | $23.42 | $23.96 | $26.06 | $20.01 | $21.20 | -11.54% |

| 2022 | $21.76 | $22.81 | $26.90 | $17.83 | $23.96 | 2.64% |

| 2021 | $25.14 | $27.36 | $29.42 | $21.49 | $23.35 | -11.55% |

| 2020 | $20.69 | $18.05 | $29.26 | $11.77 | $26.40 | 47.44% |

| 2019 | $16.22 | $15.65 | $19.55 | $14.32 | $17.90 | 15.36% |

| 2018 | $15.71 | $17.21 | $17.62 | $13.98 | $15.52 | -9.40% |

| 2017 | $17.07 | $16.41 | $18.51 | $15.43 | $17.13 | 7.12% |

| 2016 | $17.17 | $13.84 | $20.70 | $13.75 | $15.99 | 15.86% |

| 2015 | $15.66 | $15.71 | $18.23 | $13.70 | $13.80 | -13.59% |

| 2014 | $19.07 | $19.94 | $22.05 | $15.28 | $15.97 | -18.10% |

| 2013 | $23.79 | $30.87 | $32.23 | $18.61 | $19.50 | -34.89% |

| 2012 | $31.15 | $28.78 | $37.23 | $26.67 | $29.95 | 6.28% |

| 2011 | $35.12 | $30.67 | $48.70 | $26.16 | $28.18 | -8.00% |

| 2010 | $20.19 | $17.17 | $30.70 | $15.14 | $30.63 | 80.28% |

| 2009 | $14.67 | $11.08 | $19.18 | $10.51 | $16.99 | 57.46% |

| 2008 | $14.99 | $14.93 | $20.92 | $8.88 | $10.79 | -26.90% |

| 2007 | $13.38 | $13.01 | $15.82 | $11.67 | $14.76 | 14.42% |

| 2006 | $11.55 | $9.04 | $14.94 | $8.83 | $12.90 | 46.09% |

| 2005 | $7.31 | $6.39 | $9.23 | $6.39 | $8.83 | 29.47% |

| 2004 | $6.66 | $5.99 | $8.29 | $5.50 | $6.82 | 14.24% |

| 2003 | $4.88 | $4.74 | $5.97 | $4.37 | $5.97 | 27.84% |

| 2002 | $4.60 | $4.59 | $5.10 | $4.24 | $4.67 | 3.32% |

| 2001 | $4.37 | $4.59 | $4.82 | $4.07 | $4.52 | -1.31% |

| 2000 | $4.95 | $5.30 | $5.45 | $4.57 | $4.58 | -14.07% |

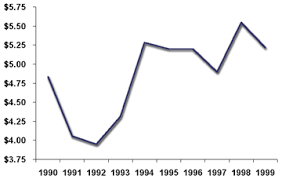

| 1999 | $5.22 | $5.00 | $5.75 | $4.88 | $5.33 | 6.39% |

| 1998 | $5.54 | $5.94 | $7.81 | $4.69 | $5.01 | -16.50% |

| 1997 | $4.90 | $4.77 | $6.27 | $4.22 | $6.00 | 25.00% |

| 1996 | $5.20 | $5.17 | $5.83 | $4.71 | $4.80 | -6.61% |

| 1995 | $5.20 | $4.84 | $6.04 | $4.42 | $5.14 | 5.98% |

| 1994 | $5.29 | $5.28 | $5.75 | $4.64 | $4.85 | -5.27% |

| 1993 | $4.31 | $3.66 | $5.42 | $3.56 | $5.12 | 39.51% |

| 1992 | $3.95 | $3.87 | $4.34 | $3.65 | $3.67 | -4.92% |

| 1991 | $4.06 | $4.16 | $4.57 | $3.55 | $3.86 | -7.88% |

| 1990 | $4.83 | $5.21 | $5.36 | $3.95 | $4.19 | -19.73% |

| 1989 | $5.50 | $6.07 | $6.21 | $5.05 | $5.22 | -13.72% |

| 1988 | $6.53 | $6.64 | $7.82 | $6.05 | $6.05 | -9.70% |

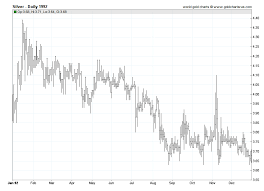

| 1987 | $7.02 | $5.36 | $10.93 | $5.36 | $6.70 | 26.89% |

| 1986 | $5.47 | $5.81 | $6.31 | $4.85 | $5.28 | -8.97% |

| 1985 | $6.13 | $6.25 | $6.75 | $5.45 | $5.80 | -7.79% |

| 1984 | $8.15 | $8.96 | $10.11 | $6.22 | $6.29 | -29.41% |

| 1983 | $11.42 | $11.07 | $14.67 | $7.54 | $8.91 | -18.03% |

| 1982 | $7.92 | $8.06 | $11.11 | $4.90 | $10.87 | 33.37% |

| 1981 | $10.49 | $15.80 | $16.30 | $8.03 | $8.15 | -47.42% |

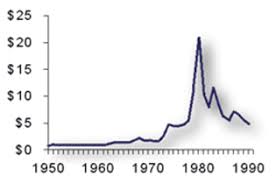

| 1980 | $20.98 | $39.95 | $49.45 | $10.89 | $15.50 | -51.86% |

| 1979 | $11.07 | $6.08 | $32.20 | $5.94 | $32.20 | 434.88% |

| 1978 | $5.42 | $4.87 | $6.26 | $4.82 | $6.02 | 26.47% |

| 1977 | $4.64 | $4.43 | $4.98 | $4.31 | $4.76 | 9.17% |

| 1976 | $4.35 | $4.16 | $5.08 | $3.83 | $4.36 | 4.31% |

| 1975 | $4.43 | $4.44 | $5.21 | $3.93 | $4.18 | -6.49% |

| 1974 | $4.67 | $3.28 | $6.76 | $3.27 | $4.47 | 37.12% |

| 1973 | $2.55 | $2.04 | $3.26 | $1.96 | $3.26 | 60.59% |

| 1972 | $1.68 | $1.37 | $2.03 | $1.37 | $2.03 | 48.18% |

| 1971 | $1.54 | $1.65 | $1.75 | $1.27 | $1.37 | -15.95% |

| 1970 | $1.77 | $1.80 | $1.93 | $1.57 | $1.63 | -8.94% |

| 1969 | $1.80 | $1.96 | $2.04 | $1.56 | $1.79 | -8.21% |

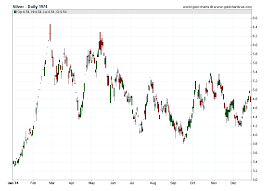

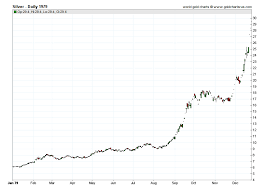

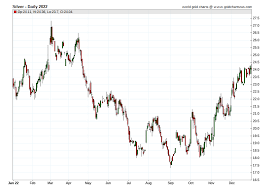

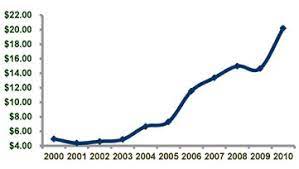

Historical Chart

In the realm of bullion, silverware, and jewelry, silver’s allure remains constant, but its market value can be unpredictable. The record highs and lows over the years encapsulate its volatile nature within the economy.

This metal’s price history not only offers a glimpse into its past role but also aids in understanding future market behaviors. Investors often scrutinize these trends through detailed graph analysis, considering both the data on hand and the broader implications of global economic shifts. As a result, silver continues to be a key component in both investment portfolios and industrial applications, its allure enduring even amidst market fluctuations.

In this comprehensive analysis, we delve into the historical trends of silver prices, examining the factors that influence them and how they correlate with the economy and inflation.

From forecasting future prices to developing investment strategies, this article provides a data-driven exploration of silver price history that will satisfy your analytical mind.

Introduction to Silver Price History

Gain a comprehensive understanding of the history of silver prices on this page. We provide insights into the historical trends in silver prices, allowing for valuable insights into the factors that have influenced its value over time.

The data includes key events such as economic recessions, wars, and changes in government policies, which have significantly impacted the silver market. Additionally, statistical analysis, charts, and graphs illustrate price fluctuations and trends.

Familiarizing oneself with silver’s price history is essential for informed investment decisions and predicting future market movements. Therefore, taking the time to explore this information will equip individuals with the knowledge needed to navigate the world of silver trading.

Historical Silver Prices

Take a closer look at the historical silver prices and see how they fluctuated over time due to various economic factors. Understanding the silver price history can provide valuable insights into market trends and investment opportunities. Here are some key points to consider:

- Supply and demand: The balance between supply and demand plays a significant role in determining silver prices. Factors such as industrial demand, mining production, and investor sentiment can impact the availability and scarcity of silver.

- Inflation and currency fluctuations: Silver prices are often influenced by inflation and currency movements. When inflation rises or the value of a currency weakens, investors tend to flock to silver as a hedge against these economic uncertainties.

- Geopolitical events: Political instability, trade disputes, and global economic events can have a substantial impact on silver prices. These events can create fluctuations in the market and affect investor sentiment.

Factors Influencing Silver Prices

Factors influencing silver prices can be attributed to various market demand impacts. These impacts include factors such as:

- Industrial demand

- Investor sentiment

- Global economic conditions

Understanding these influences is crucial in analyzing the volatility and trends in silver prices.

Market Demand Impact

Silver prices have experienced a significant decrease due to the recent decline in market demand. This decline in demand can be attributed to several factors:

- Economic slowdown: With the global economy facing uncertainties, investors are becoming more cautious, resulting in a decrease in demand for silver as a safe-haven investment.

- Industrial demand: Silver is widely used in various industries, such as electronics and solar panels. The recent slowdown in these sectors has led to a decrease in the demand for silver.

- Shift in investor sentiment: The recent surge in stock markets and other investment options has diverted investor attention away from silver, leading to a decrease in demand.

Analyzing historical trends, it’s evident that silver prices are highly influenced by market demand. As demand decreases, prices tend to follow suit. However, it’s important to note that market demand is just one of the many factors that affect silver prices, and a thorough analysis of all influencing factors is necessary for a comprehensive understanding of price movements.

Silver Price Trends

Are you curious about the current trends in silver prices?

Well, let’s take a look at the data.

Over the past year, silver prices have shown a steady increase, with a notable surge in the last quarter.

However, it’s important to note that the future direction of silver prices is influenced by various factors, such as market demand, geopolitical events, and economic indicators.

Are silver prices going up or down?

You should keep an eye on the market to see if the price of silver is headed in a positive or negative direction. The silver price history reveals a comprehensive analysis of historical trends, allowing investors to make informed decisions.

Here are three key factors to consider when analyzing the silver market:

- Global economic indicators: The price of silver is often influenced by macroeconomic factors such as inflation, interest rates, and geopolitical events. Monitoring these indicators can provide insights into the future direction of silver prices.

- Demand and supply dynamics: Silver is used in various industries, including electronics and jewelry. Understanding the demand and supply dynamics can help predict price movements.

- Investor sentiment: The market sentiment towards silver can impact its price. Monitoring investor sentiment indicators, such as trading volumes and open interest, can provide valuable insights.

Silver Price Forecasting

If you regularly follow the silver market, you’ll know that accurately forecasting its price can be quite challenging. However, by examining the silver price history and analyzing historical trends, we can gain valuable insights that can help inform our silver price forecasting.

Looking at the past performance of silver prices, we can identify patterns and trends that may indicate potential future price movements. For example, historical data reveals that silver prices tend to be influenced by factors such as market demand, economic conditions, and geopolitical events.

By analyzing these historical trends and considering current market conditions, we can make more informed predictions about the future direction of silver prices. However, it’s important to note that forecasting is inherently uncertain, and past performance isn’t always indicative of future results.

Therefore, it’s essential to use a combination of historical analysis and ongoing market monitoring to make the most accurate silver price forecasts possible.

Silver Price Volatility

To navigate the current silver price volatility, you should closely monitor market indicators and adjust your investment strategy accordingly. The silver market has experienced fluctuations in recent years, making it essential to stay informed and make informed decisions.

Here’s what you need to know:

- Analyze the silver price history: Understanding the historical trends can provide valuable insights into the market’s behavior and help you make informed decisions.

- Monitor market indicators: Keep a close eye on factors such as supply and demand, economic indicators, and geopolitical events that can impact the silver price.

- Adjust your investment strategy: Based on your analysis and market indicators, consider adjusting your portfolio allocation to manage risk and take advantage of potential opportunities.

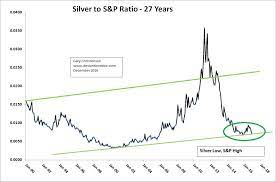

Silver Price Correlations

How do silver price correlations affect your investment decisions and risk management strategies?

Analyzing historical data can provide valuable insights into the relationship between silver prices and other financial assets. By identifying correlations, you can better understand the potential impact of changes in silver prices on your investment portfolio.

For example, if silver prices have a strong positive correlation with gold prices, you may consider diversifying your portfolio to include both assets, as they tend to move in tandem. On the other hand, if silver prices have a negative correlation with stock market indices, you may choose to allocate more of your investments to silver as a hedge against market volatility.

Silver Price and the Economy

You should consider the relationship between the silver price and the economy, as it can provide valuable insights into market trends and potential investment opportunities. Understanding the historical trends of the silver price in relation to the economy can help you make informed decisions about your investments.

Here are three key points to consider:

- Market Volatility: The silver price tends to be more volatile during periods of economic uncertainty. Economic downturns or financial crises often lead to an increase in silver prices as investors seek safe-haven assets.

- Industrial Demand: The economy plays a significant role in determining the demand for silver in various industries, such as electronics, solar panels, and jewelry. Economic growth and industrial expansion can drive up the demand for silver, which can impact its price.

- Inflation Hedge: Historically, silver has been seen as a hedge against inflation. When inflation rates rise, the value of fiat currencies declines, and investors often turn to tangible assets like silver to protect their wealth.

Silver Price and Inflation

Have you considered the impact of inflation on the silver price? Understanding the historical trends can provide valuable insights into this relationship.

Over the years, silver has been regarded as a safe haven asset, often sought after during times of economic uncertainty. One key factor that influences the silver price is inflation. When inflation rises, the purchasing power of fiat currency decreases, leading investors to seek alternative investments such as silver.

Historical data shows that during periods of high inflation, the silver price tends to increase. For example, during the 1970s when inflation soared, the silver price skyrocketed from around $1.50 per ounce to nearly $50 per ounce.

Therefore, it’s important to consider the impact of inflation when analyzing the silver price history and potential investment opportunities.

Silver Price and Investment Strategies

So, if you’re looking to diversify your portfolio, considering the silver price and exploring different investment strategies could be a wise move. The silver price has shown a volatile history, making it an attractive option for investors seeking potential gains. Here are three investment strategies to consider:

- Dollar-cost averaging: By investing a fixed amount in silver regularly, you can mitigate the impact of market fluctuations and take advantage of both high and low silver prices over time.

- Silver ETFs: Exchange-traded funds (ETFs) offer a convenient way to invest in silver without physically owning it. These funds track the silver price and allow investors to buy and sell shares on the stock exchange.

- Silver mining stocks: Investing in companies engaged in silver mining can provide exposure to the silver industry’s potential upside while diversifying your portfolio.

Frequently Asked Questions

How Does the Silver Price History Compare to Other Precious Metals Like Gold or Platinum?

The silver price history can be compared to other precious metals like gold or platinum by analyzing their historical trends. This analysis provides valuable insights into how silver has performed relative to its counterparts over time.

What Are Some Key Events or Milestones in the Silver Price History That Have Had a Significant Impact on Its Value?

Some key events or milestones in silver price history that have significantly impacted its value include economic recessions, geopolitical tensions, changes in industrial demand, and monetary policy decisions.

Can the Historical Silver Price Data Be Used to Predict Future Price Movements Accurately?

You can use historical silver price data to predict future price movements accurately, just like a skilled navigator uses the stars to guide their ship. Analyzing patterns and trends can provide valuable insights for making informed decisions.

Are There Any Specific Industries or Sectors That Have a Strong Influence on Silver Prices?

Certain industries or sectors can strongly influence silver prices. For example, demand from the technology sector, especially for electronic components, has a significant impact on silver prices due to its high conductivity and other desirable properties.

How Do Global Economic Factors, Such as Trade Wars or Currency Fluctuations, Affect the Silver Price?

Global economic factors, like trade wars and currency fluctuations, have a significant impact on the price of silver. These factors can create volatility in the market and influence investor sentiment, ultimately affecting the supply and demand dynamics of silver.

Featured Business Profile

Money Metals Exchange

(800) 800-1865

customersupport@moneymetals.com

Founded: 2010

-

- Tiktok

- linkedin.com

- Quora

- twitch

- scribd.com

- TradingView

- wattpad.com

- GoodReads

- Ultimate Guitar

- soundcloud.com

- Foursquare

- slideshare.net

- BuzzFeed

- crunchbase.com

- last.fm

- deviantart.com

- behance.net

- Wikidot

- Linktree

- Academia.edu

- Wix

- vimeo.com

- issuu

- instructables

- Dribbble

- imgur

- Fodors

- DP Review

- Jimdo

- The Noun Project

- moz.com

- MySpace

- F6S

- Tripod

- Feedspot

- about.me

- zotero

- Orcid

- Angelfire

- Plurk

- Daily Kos

- Mastodon

- disqus.com

- Spatial.io

- Strikingly

- pearltrees.com

- ed.ted.com

- HubPages

- scoop.it

- Ucoz

- visually

- PBase.com

- LiveJournal

- Speaker Deck

- MagCloud

- Threads

- Merchant Circle

- Brand Yourself

- Colour Lovers

- instapaper.com

- ApSense

- Blog Talk Radio

- Investagrams

- Edublogs

- aboutus.org

- Minds

- bookcrossing

- Linkin

- Live Leak

- Biggerplate

- Angel List

- AllMyFaves

- zumvu

- Blogarama

- Protopage

- EmpowHER

- Knowem

- Care2

- papaly

- BizSugar

- Intense Debate

- calameo

- Bookmarx

- followus

- Ryze

- CreateSpace

- Yola

- Nfomedia

- Blogster

Historical Silver Price (1968-2022)

1969 Silver Prices & Cost Of Living: A Look Back

The year 1969 was a time of great change and upheaval in the United States. It was a year marked…

1972 Silver Prices: Fluctuations And Trends

Silver has long been a valuable commodity, prized for its versatility, beauty, and economic significance. Throughout history, silver prices have…

1974 Silver Prices: Volatility Amid Economic Uncertainty

In 1974, the price of silver experienced significant fluctuations, influenced by various economic and global factors. This period was marked…

1975 Silver Prices: Fluctuations And Trends

In 1975, silver prices experienced significant fluctuations, with the highest recorded price at $5.21 per ounce on August 11th and…

1976 Silver Prices: A Historical Look At Fluctuations

Silver has been a valuable commodity for centuries, with its price fluctuating over time due to various economic and political…

1978 Silver Prices: Fluctuations & Highs

The year 1978 witnessed significant fluctuations in the silver market, with prices ranging between $4.87 oz and $6.26 oz. According…

1979 Silver Prices: Fluctuations, Increases, And Historical Trends

The price of silver has been a significant economic indicator for investors and analysts alike, with its fluctuations and increases…

1980 Silver Prices: From $5 To $50 In 2 Years

In the late 1970s and early 1980s, the world experienced a significant increase in commodity prices, including silver. Over the…

1983 Silver Prices: Tracking Daily Fluctuations

The price of silver has been a subject of interest for many investors and traders due to its high volatility…

1984 Silver Prices: Fluctuations And Trends

Silver prices have been subject to various economic and political events that have influenced their movements over the years. The…

1988 Silver Prices: Fluctuations, Factors, And Geopolitics

The fluctuations of silver prices have been a topic of interest for economists and investors alike, as they are influenced…

1995 Silver Prices: A Snapshot Of The Past

The study of past market trends is crucial for understanding the behavior of modern financial markets. Silver, a precious metal…

2020 Silver Prices: Fluctuations, Pandemic Impact, And Stock Market Crash

The year 2020 was a rollercoaster ride for the silver market, as it experienced unprecedented fluctuations due to a combination…

2022 Silver Price Forecast & Factors Affecting It

The silver market is a complex and multifaceted system that is influenced by various factors. In 2022, the silver price…

Silver Price Data 2013: Fluctuations And Trends

The year 2013 was a tumultuous one for the silver market, marked by significant fluctuations and trends that impacted investors…

Silver Price Fluctuations: Factors & Trends

The price of silver is known for its volatility and is influenced by a wide range of factors. Understanding these…

Silver Prices 2000: Historical Data & Federal Debt

The year 2000 was a significant turning point in the history of silver prices and the US federal budget. During…

Silver Prices 2009: Fluctuations, Trends & Factors

The year 2009 marked a significant period for silver prices, as they experienced significant fluctuations throughout the year. The market…

Silver Prices 2010: Fluctuations, Records & Allegations

The year 2010 marked a significant period for silver prices, with the metal experiencing wide fluctuations and setting record highs.…

Silver Prices And 1971 Real Estate & Car Costs

In 1971, the global economy underwent a significant transformation that impacted various industries, including silver, real estate, and automobiles. The…

Silver Prices During 2008 Financial Crisis

Silver suffered a severe setback during the 2008 global financial crisis, which had a profound impact on the world's economy.…

Silver Prices In 1968: A Window Into Economic Conditions

The year 1968 was a significant period in history marked by a series of events that shaped the political and…

Silver Prices In 1970: A Look Back At The Past

In 1970, the average price of silver was $1.72 per ounce, and it fluctuated between $1.57 and $1.78 per ounce.…

Silver Prices In 1973: Daily Fluctuations & Historical Data

This article delves into the daily fluctuations and historical data of silver prices in 1973, a year marked by significant…

Silver Prices In 1981: From Highs To Lows

In 1981, the price of silver experienced a significant rollercoaster ride, with prices fluctuating from highs to lows over the…

Silver Prices In 1982: Fluctuations And Surprises!

In 1982, the price of silver experienced significant fluctuations and surprises, with prices ranging from $4.90 to $8.66 per ounce.…

Silver Prices In 1985: Fluctuations And Historical Data

The price of silver is a subject of interest for investors and traders alike. The market for silver is known…

Silver Prices In 1986: Key Facts & Figures

The year 1986 was a significant year for the silver industry, marked by the launch of the American Silver Eagle…

Silver Prices In 1989: Fluctuations And Trends!

This article aims to explore the fluctuations and trends of silver prices in 1989. Using historical data provided by SD…

Silver Prices In 1990: Fluctuations And Factors

The year 1990 marked a period of significant volatility in the prices of silver, with daily prices fluctuating between $3.96…

Silver Prices In 1992: Historical Data And Ranges

Silver prices in 1992 provide a historical snapshot of the precious metal's value during a particular time period. This data…

Silver Prices In 1993: Fluctuations And Peaks

The year 1993 witnessed a range of fluctuations and peaks in silver prices, according to historical data from the London…

Silver Prices In 1994: Historical Data For Investors

Silver has been a valuable commodity for centuries, with its use ranging from currency to industrial applications. As with any…

Silver Prices In 1996: Fluctuations From $4.73 To $5.26 Oz

The year 1996 saw significant fluctuations in the price of silver, with values ranging from $4.73 to $5.26 per ounce.…

Silver Prices In 1997: Fluctuations, Trends, And Market Insights

The year 1997 was marked by significant fluctuations in the prices of silver, which were influenced by market demand and…

Silver Prices In 1998: A Recap

The year 1998 saw significant fluctuations in the price of silver, with the London Bullion Market Association (LBMA) reporting an…

Silver Prices In 1999: Fluctuations And Stabilization

In 1999, the price of silver experienced a significant degree of fluctuation, with prices ranging from $4.88/oz to $5.71/oz. Despite…

Silver Prices In 2001: Fluctuations, Spikes, And The Aftermath Of 9/11

Silver Price in 2001 In the year 2001, the average price of silver was $4.37 per troy ounce. The year…

Silver Prices In 2002: Fluctuations And Trends

Despite a persistent global economic slowdown, silver’s price in 2002 displayed remarkable resilience. At an average of $4.60 per ounce,…

Silver Prices In 2003: Fluctuations And Trends

The year 2003 saw significant fluctuations in silver prices, with the metal experiencing both highs and lows throughout the year.…

Silver Prices In 2005: Fluctuations, Trends, And Factors

The year 2005 was a significant year for the silver market, marked by considerable fluctuations in price and influenced by…

Silver Prices In 2006: A Rollercoaster Ride

In 2006, the silver market experienced a turbulent ride, with daily prices fluctuating between $10.52 to $14.05 per ounce. The…

Silver Prices In 2007: Fluctuations And Trends

Silver prices in 2007 experienced a range of fluctuations and trends that were influenced by various market forces. This article…

Silver Prices In 2011: Fluctuations And Record Highs

In 2011, the world witnessed significant fluctuations and record highs in silver prices. This precious metal, which has been a…

Silver Prices In 2012: Peaks And Lows

Silver prices in 2012 witnessed a rollercoaster ride, seeing spot prices soaring to the highest point of $34.71 per ounce…

Silver Prices In 2014: Daily Fluctuations & Lbma Fixes

The year 2014 was marked by a series of fluctuations in silver prices, with prices ranging from $15.32 oz to…

Silver Prices In 2015: Fluctuations And Manipulation Allegations

Silver prices in 2015 were like a wild rollercoaster ride, with prices fluctuating significantly throughout the year. From January to…

Silver Prices In 2016: Historical Data & Trends

Silver, a precious metal with a rich history and cultural significance, has been a popular investment and trading commodity for…

Silver Prices In 2017: A Year Of Fluctuations

The year 2017 was a tumultuous year for the silver market, with prices experiencing significant fluctuations. The price of silver…

Silver Prices In 2018: Fluctuations And Influential Factors

Silver prices in 2018 were subject to fluctuations due to a variety of influential factors that impacted the global market.…

Silver Prices Soar In 2021 Amid Market Volatility

The year 2021 has seen a surge in silver prices, with investors turning to the precious metal as a safe…

The History and Significance of Silver Thursday: a Look at the Day That Changed the Financial Markets Forever

Are you ready to dive into the day that forever altered the financial markets? Step into the captivating story of…

The Silver Price Journey In 1977: Fluctuations And Trends.

In 1977, the price of silver experienced a tumultuous journey with significant fluctuations and trends. It was a year marked…

The Silver Price Rollercoaster: 1987 Recap

The silver market experienced a tumultuous year in 1987 as prices fluctuated drastically over the course of twelve months. The…

Tracking 2004 Silver Prices: Fluctuations, Factors, And Historical Data

In 2004, the price of silver experienced a remarkable year of fluctuation, influenced by a multitude of factors, including supply…