Do you feel like your investment in silver is slipping through your fingers like sand? Wondering why the silver price is dropping?

Look no further. This article explores the economic factors driving the decline in silver prices. From the impact of investor sentiment to fluctuations in the US dollar value, we delve into the supply and demand dynamics in the silver market.

Stay tuned to uncover the potential implications for investors in this current silver price drop.

Key Takeaways

- Global economic slowdown and decreased demand in industries such as electronics and solar panels are contributing to the drop in silver prices.

- The strength of the US dollar is making silver more expensive for investors, reducing demand and causing prices to decline.

- Ongoing trade tensions are causing uncertainty and leading investors to seek safer assets, decreasing demand for silver.

- Optimistic investor sentiment leads to more investment in riskier assets, reducing demand for silver, while negative sentiment and fear of economic uncertainty drive investors to seek safe-haven assets like silver, increasing demand and driving up prices.

Economic Factors Affecting Silver Prices

You may be wondering why the price of silver is dropping due to economic factors. Well, there are several key reasons behind this downward trend.

Firstly, the global economy is currently experiencing a slowdown. As a result, the demand for silver, which is often used in industries such as electronics and solar panels, has decreased.

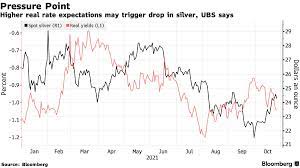

Additionally, the strength of the US dollar plays a significant role in shaping silver prices. When the dollar strengthens, it becomes more expensive for investors to purchase silver, leading to a decrease in demand and subsequently, a drop in prices.

Moreover, the ongoing trade tensions between major economies have also negatively impacted the silver market. As uncertainty looms, investors tend to seek safer assets, causing a decrease in demand for silver.

These economic factors are important in understanding the dynamics behind the declining silver prices.

The impact of investor sentiment on the silver market is another crucial aspect to consider.

Impact of Investor Sentiment on Silver Market

Investor sentiment can greatly influence the movement of the silver market. When investors are optimistic about the economy and financial markets, they tend to invest more in riskier assets, such as stocks, which can lead to a decrease in demand for safe-haven assets like silver. This decrease in demand can put downward pressure on the price of silver.

On the other hand, when investor sentiment turns negative, and there’s a fear of economic uncertainty or market volatility, investors often seek refuge in safe-haven assets like silver. This increased demand can drive up the price of silver.

Therefore, understanding and analyzing investor sentiment is crucial in predicting and understanding the movement of the silver market.

Fluctuations in the Value of the US Dollar and Silver Prices

When the value of the US dollar decreases, it can lead to an increase in the price of silver. This is because silver, like many other commodities, is priced in US dollars. When the dollar weakens, it takes more dollars to purchase the same amount of silver, causing the price to rise.

The inverse relationship between the dollar and silver prices is due to the fact that a weaker dollar makes silver relatively cheaper for international buyers, increasing their demand for the metal. Additionally, a weaker dollar can also lead to inflationary pressures, which can further drive up the price of silver as a hedge against inflation.

Understanding the relationship between the value of the dollar and silver prices is crucial in analyzing supply and demand dynamics in the silver market.

Transitioning into the subsequent section, let’s now explore the supply and demand dynamics in the silver market and how they contribute to the fluctuations in silver prices.

Supply and Demand Dynamics in the Silver Market

Understanding the supply and demand dynamics in the silver market can help you make informed decisions about investing in the metal. Here are three key factors that influence the supply and demand of silver:

- Industrial demand: Silver is widely used in various industries, including electronics, solar panels, and medical equipment. Any changes in industrial demand can have a significant impact on the overall demand for silver.

- Investment demand: Many investors see silver as a store of value and a hedge against inflation. When economic conditions are uncertain, the demand for silver as an investment tends to increase.

- Mining production: The supply of silver is primarily determined by mining production. Any disruptions or changes in mining activities can affect the overall supply of silver in the market.

Potential Implications for Investors in the Current Silver Price Drop

You may be wondering about the potential implications for your investments due to the recent decrease in the value of silver.

The current drop in the silver price can affect your investment portfolio in several ways.

Firstly, if you own silver as a physical asset, the decrease in value means that the worth of your holdings has declined. This could lead to a decrease in your overall net worth.

Secondly, if you’ve invested in silver-related stocks or exchange-traded funds (ETFs), the drop in silver prices could negatively impact the value of these investments.

It’s important to closely monitor the market and consider diversifying your portfolio to mitigate the potential risks associated with the decrease in silver prices.