Silver Prices US

Check the price of silver in the U.S.

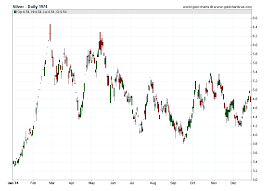

Live Silver Price

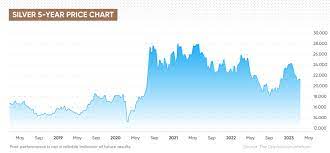

Silver, as a precious metal, has been a subject of fascination and investment for centuries. Its prices fluctuate due to various factors, leading to numerous questions from investors and enthusiasts alike. Below are some of the most frequently asked questions about silver prices, along with comprehensive answers based on the provided sources.

Silver Price History

1980 Silver Prices: From $5 To $50 In 2 Years

In the late 1970s and early 1980s, the world experienced a significant…

1972 Silver Prices: Fluctuations And Trends

Silver has long been a valuable commodity, prized for its versatility, beauty,…

1969 Silver Prices & Cost Of Living: A Look Back

The year 1969 was a time of great change and upheaval in…

1974 Silver Prices: Volatility Amid Economic Uncertainty

In 1974, the price of silver experienced significant fluctuations, influenced by various…

1975 Silver Prices: Fluctuations And Trends

In 1975, silver prices experienced significant fluctuations, with the highest recorded price…

1976 Silver Prices: A Historical Look At Fluctuations

Silver has been a valuable commodity for centuries, with its price fluctuating…

What Determines the Spot Price of Silver?

Why Do Silver Prices Fluctuate?

Silver prices fluctuate due to a combination of macroeconomic factors, market sentiment, and industry-specific dynamics. Global economic conditions, including inflation rates, interest rates, and economic growth, play a significant role. Market sentiment can change rapidly with geopolitical events, affecting investor demand for silver as a safe-haven asset. Industrial demand, driven by silver’s use in electronics, green technologies, and other sectors, also impacts prices. Additionally, mining production levels and geopolitical stability in major silver-producing regions contribute to price volatility.

Can Silver Reach $100, $300, or $1,000 Per Ounce?

Predictions of silver reaching extremely high prices per ounce have circulated for some time, driven by online hype cycles. While silver has intrinsic value due to its scarcity and utility, and its value has increased significantly since the 1990s, reaching such high prices would require extraordinary market conditions. Historical price movements, such as the spike in 1980 due to market manipulation by the Hunt Brothers, and the all-time high in 2011, provide some context for potential price limits. However, long-term forecasts are inherently uncertain due to market volatility.

What is the Difference Between Bid, Ask, and Spread Price?

The bid price is the highest price a buyer is willing to pay for silver, while the ask price is the lowest price a seller is willing to accept. The spread is the difference between these two prices. The bid-ask spread can serve as an indicator of the liquidity and transaction costs associated with trading silver. A narrower spread typically indicates higher liquidity and lower transaction costs.

Why Can't I Buy Silver at the Spot Price?

When purchasing silver, investors pay a premium over the spot price. This premium covers the costs of refining, minting, and distributing the silver, as well as the dealer’s profit margin. The premium varies depending on the form of silver (e.g., coins, bars, rounds) and the quantity purchased. While the spot price reflects the current market value of silver, the retail price includes these additional costs.

How Do I Invest in Silver?

At What Price Should I Buy Silver

Are you considering investing in silver? Wondering when the right time to…

How To Buy Silver At Market Price

Are you tired of overpaying for silver? It's time to take control…

How To Buy Silver At Spot Price

Imagine you're on a treasure hunt, searching for a hidden gem that…

Where To Buy Silver At Market Price

Are you ready to dive into the world of silver? Look no…

Where To Buy Silver Bars At Market Price

Looking to buy silver bars at market price? Look no further! In…

Where To Buy Silver At The Best Price

Did you know that the price of silver has increased by over…