In an era of economic uncertainty, the silver market has emerged as a labyrinth of intrigue and unforeseen trends. The recent study, “A Macroeconomic Viewpoint Using a Structural VAR Analysis of Silver Price Behaviour” by Zurika Robinson, throws light on the baffling behavior of silver prices since the financial crisis of 2007-2009. Here’s a deep dive into the whirlwind journey of silver prices and the factors driving their unpredictable course.

The Symbiotic Relationship Between Silver, Gold, and Oil

Silver’s relationship with gold has always been a topic of interest. The study underscores how silver prices have mirrored the trends of gold, their more famous counterpart. When gold prices soar, silver isn’t far behind. But the true surprise lies in silver’s reaction to oil price shocks. The study documents a startling spike in silver prices following short-term fluctuations in oil prices, a pattern that stabilizes over the long haul.

Economic Indicators: The Silent Puppeteers

Ever wondered how the broader economy impacts silver prices? Robinson’s study reveals a striking correlation between the Gross Domestic Product (GDP) of OECD countries and silver prices. An upsurge in the GDP often translates to a hike in silver prices, painting a vivid picture of silver’s sensitivity to economic output.

But that’s not all. The study also highlights the impact of the US Federal funds rate and the US real effective exchange rate on silver prices. A jolt to the Federal funds rate initially dips silver prices, only to see a gradual rise and eventual stabilization.

Silver: The Unsung Hero in Times of Crisis

One of the most compelling aspects of the study is its emphasis on silver as a safe haven. Amidst global crises, like the COVID-19 pandemic and geopolitical tensions, silver has stood as a beacon of stability for investors.

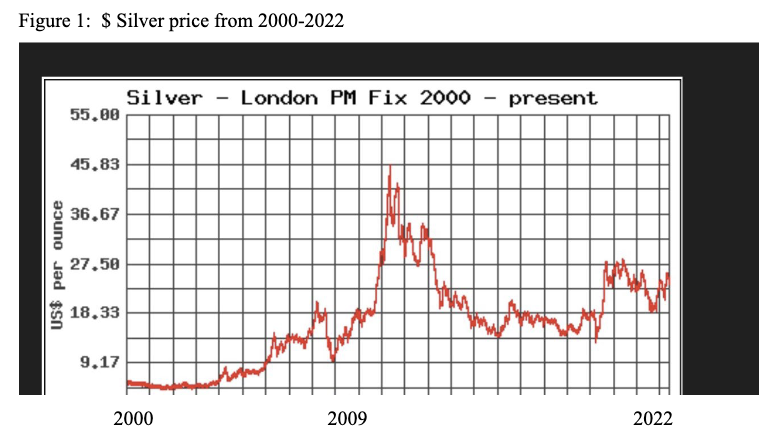

A Journey Through Numbers

Let’s talk numbers. Between 2000 and 2022, silver prices hit a staggering high of $46 per ounce post-2009. However, this peak was short-lived as prices plummeted to less than $20 per ounce, only to resurge to around $28 amid the pandemic and heightened global tensions.

Wrapping Up

The study by Zurika Robinson is not just an analysis; it’s a revelation. It paints a vivid picture of the silver market’s complex and often surprising relationship with global economic forces. In a world riddled with economic ups and downs, silver’s rollercoaster journey is a testament to its resilience and the underlying forces that shape its destiny.

So, next time you hear about fluctuations in the silver market, remember, it’s more than just numbers – it’s a reflection of our global economic heartbeat.