The year 1968 was a significant period in history marked by a series of events that shaped the political and social landscape of the time. It was also a year that experienced notable fluctuations in silver prices, reflecting the economic conditions of the era.

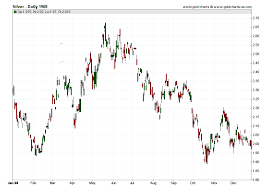

Silver prices in 1968 were affected by various factors, including the demonetization of silver by the US government and the establishment of the LBMA Silver Price Auction. During this period, silver prices fluctuated between $1.90 oz and $2.65 oz, reflecting the impact of several economic factors.

Additionally, the US government’s decision to demonetize silver led to a decrease in demand, further affecting the market. The establishment of the LBMA Silver Price Auction provided a new avenue for determining composite prices for trading in the over-the-counter silver bullion markets, leading to a shift in the dynamics of the market.

By analyzing these factors, we gain insight into the economic conditions of the time and their impact on the silver market.

Fluctuations and Trends

The fluctuation of silver prices in 1968, ranging from $1.84 oz to $2.58 oz, provides insight into the economic conditions of the time, with the highest prices occurring in November and December and the lowest in October, indicating a trend of instability throughout the year. The causes of silver price fluctuations can be attributed to various economic factors, including changes in demand and supply, geopolitical tensions, and inflation.

The impact of silver prices on different industries, such as jewelry, electronics, and manufacturing, can also be observed. For instance, high silver prices may increase the cost of production for manufacturers, leading to higher prices for consumers and reduced demand for their products.

Despite the relative stability of silver prices from June to September, the overall trend of fluctuation highlights the economic uncertainties and challenges faced during this period. The demonetization of silver, which began in the early 1960s and accelerated with the Coinage Act of 1965, added to the pressures on the silver market.

The LBMA Silver Price Auction, which began in 1897, provided a benchmark for silver prices, reflecting the composite prices arrived at by various trading banks and brokerages in the over-the-counter silver bullion markets. Overall, the fluctuations and trends in silver prices in 1968 serve as a valuable historical indicator of economic conditions and the impact of various factors on commodity markets.

US Silver Certificates

Authorized by the Silver Purchase Act of 1934, US silver certificates were legal tender notes that could be redeemed for physical silver until June 24, 1968, after which they could only be exchanged for Federal Reserve Notes.

The redemption process allowed holders of silver certificates to profit by redeeming them for physical silver and then selling the silver.

However, the demonetization of silver was on the rise during the 1960s, and the US government began a program to demonetize silver.

This was evident in the Coinage Act of 1965, which eliminated the use of 90% silver dimes and silver quarters, and the withdrawal of silver coins from US coin circulation in 1967.

The demonetization of silver ultimately impacted the currency value of silver certificates, as they could no longer be redeemed for physical silver after June 24, 1968.

The impact of the demonetization of silver on the value of US silver certificates was significant.

Prior to the demonetization, silver certificates held value as they could be redeemed for physical silver.

However, once silver certificates could no longer be exchanged for physical silver, their value decreased.

The demonetization of silver also highlighted the shift towards fiat currency, where currency is not backed by a physical commodity.

This shift impacted the overall economy and monetary policy, leading to a new era of financial regulation and government oversight.

Demonetization of Silver

Demonetization of silver had a significant impact on the value of US silver certificates and highlighted the shift towards fiat currency. As the US government began to phase out the use of silver in currency, the value of silver certificates declined. Holders of silver certificates were given one year to redeem their certificates for physical silver held by the US Treasury. However, after June 24, 1968, silver certificates could only be exchanged for Federal Reserve Notes and not silver bullion. This change in policy marked a significant shift towards fiat currency and away from the use of precious metals to back currency.

The demonetization of silver also had a significant impact on the silver mining industry. As demand for silver in currency declined, the global demand for silver shifted towards industrial uses. This shift in demand resulted in a decrease in the price of silver and a decrease in the profitability of silver mining operations. Despite these challenges, the silver mining industry continued to adapt to changing market conditions and remains an important part of the global economy today.

Overall, the demonetization of silver in the 1960s highlights the complex interplay between economic policy, currency, and the commodities market.

LBMA Silver Price Auction

The LBMA Silver Price Auction provides insight into the valuation of silver in the global marketplace. It is an important tool used by traders to gauge market impact and develop trading strategies. The LBMA Silver Price Auction is a daily process in which participating banks and brokerages submit buy and sell orders for silver bullion. The auction begins with the highest bidder and the lowest seller, and the price is adjusted until a balance is reached. The resulting LBMA Silver Price Fix is used as a benchmark for the global silver market.

Traders use the LBMA Silver Price to make informed decisions about buying or selling silver. It is used as a reference point for contracts, derivatives, and exchange-traded funds. The auction provides a transparent and fair mechanism for determining the price of silver, which is important for maintaining market stability. Understanding the LBMA Silver Price Auction is crucial for anyone interested in the silver market, as it can provide valuable insights into trading strategies and market trends.

Frequently Asked Questions

How did the prices of silver in 1968 compare to previous years?

There is no information provided on the prices of silver in previous years, therefore a comparison with gold cannot be made. However, historical significance of silver prices in 1968 lies in its fluctuations throughout the year and its relation to economic factors.

Were there any notable events or news that affected the prices of silver in 1968?

The prices of silver in 1968 were influenced by various factors including the impact of global trade and changes in investment strategies. Notable events such as the demonetization of silver and the repeal of the Silver Purchase Act of 1934 also affected silver prices.

What was the impact of the demonetization of silver on the overall economy?

The demonetization of silver had a significant impact on the overall economy, including exports. Government policies aimed at eliminating the use of silver in coinage and legal tender led to a decrease in demand for silver, affecting the global silver market.

How did the prices of other precious metals, such as gold, compare to the prices of silver in 1968?

Market analysis of gold prices in 1968 reveals that gold was trading at an average price of $39.31 per ounce, higher than the average price of silver which was $1.96 per ounce. However, gold prices were more volatile than silver prices during this period.

What were some of the major industries or sectors that were affected by the fluctuations in silver prices in 1968?

The major industries affected by silver prices in 1968 were electronics, photography, and jewelry. The fluctuations in silver prices had significant economic implications for these industries, as they relied heavily on the use of silver in their products.