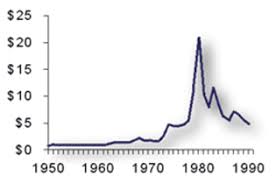

In 1977, the price of silver experienced a tumultuous journey with significant fluctuations and trends. It was a year marked by highs and lows, with the price of silver ranging from $4.31 oz to $4.98 oz in US dollars per troy ounce. The highest price was reached on March 25, 1977, while the lowest was recorded on January 12 and 14, 1977.

Throughout the year, silver prices fluctuated, with the highest prices in October and November and the lowest in August. The journey of silver price in 1977 provides insights into the volatility of commodity markets and the factors driving these fluctuations.

This article will examine the silver price journey in 1977, exploring the various trends and fluctuations that occurred throughout the year. We will examine the historical silver prices and factors affecting prices, including economic indicators, geopolitical events, and supply and demand dynamics.

Additionally, we will explore the potential for investing in silver during this time period and the implications for investors looking to profit from commodity markets. By analyzing the silver price journey in 1977, we can gain a better understanding of the factors driving commodity prices and the potential for investing in commodities.

Historical Silver Prices

The pre-existing knowledge provides detailed information on the historical silver prices in 1977. The silver market witnessed fluctuations and trends during this period, with prices ranging from $4.31 oz to $4.98 oz. The highest silver price reached $4.98 oz on March 25, 1977, while the lowest silver price reached $4.33 oz on January 12 and 14, 1977.

The daily prices of silver in 1977 ranged from $4.55 oz to $4.97 oz, with prices being highest in October and November and lowest in August. The prices increased in September and were relatively stable in December.

The global demand for silver played a significant role in shaping the price trends in 1977. The daily silver price data recorded by SDBullion.com reflects the market’s response to the fluctuations in demand. The LBMA silver price fix history data, which represents composite prices arrived at by various trading banks and brokerages, also provides insights into the silver market’s dynamics during this period.

The fluctuations in silver prices in 1977 highlight the importance of understanding the market’s demand and supply dynamics to make informed investment decisions.

Factors Affecting Prices

Various economic and political circumstances played a pivotal role in shaping the ebb and flow of the value of silver during the year of 1977, highlighting the sensitivity of the precious metals market to external factors beyond the commodity itself.

One of the most significant factors affecting the silver prices in 1977 was the supply and demand dynamics. The demand for silver was high due to its use in various industrial applications, including photography, electronics, and jewelry, among others. Meanwhile, the supply of silver was relatively low, driven by the declining output of major silver-producing countries such as Mexico and Peru. As a result, the market experienced a shortage of silver, leading to increased prices.

Another key factor influencing the silver prices in 1977 was the overall economic conditions in the United States and globally. Inflation was a major concern during this time, with many investors seeking refuge in precious metals such as silver to hedge against the potential loss of value in paper currency. Additionally, the geopolitical climate was volatile, with tensions rising between the United States and the Soviet Union.

These factors contributed to the volatility in silver prices, with prices fluctuating throughout the year in response to changing economic and political conditions. Ultimately, the silver price journey in 1977 was shaped by a complex interplay of supply and demand dynamics and broader economic and political circumstances that highlighted the sensitivity of the precious metals market to external factors.

Investing in Silver

Investment in precious metals can be a viable option for those seeking to diversify their investment portfolios.

Silver, in particular, has been a popular choice for investors due to its potential long term benefits.

Historically, silver has been used as a store of value and a hedge against inflation.

Its value has also been known to rise during times of economic uncertainty, making it an attractive investment option.

However, like any investment, there are risks involved with investing in silver.

The market for precious metals can be volatile, with prices fluctuating based on various factors such as economic conditions, global politics, and supply and demand.

Additionally, investing in physical silver can come with added costs such as storage fees and insurance.

It is important for investors to carefully consider these risks and do their research before making any investment decisions.

Frequently Asked Questions

What was the global demand for silver in 1977?

In 1977, the global demand for silver was driven by silver demand analysis and market competition. However, without further data, it is difficult to provide a comprehensive analysis of the exact demand for silver during that time period.

How did the political and economic climate of the time impact the silver market?

The political unrest and inflationary pressures of the time had a significant impact on the silver market in 1977. These factors led to increased demand for silver as a safe-haven asset, resulting in price fluctuations throughout the year.

What were the primary uses of silver in 1977?

In 1977, silver was primarily used for industrial applications and technological advancements. It was used in the production of electrical equipment, photographic materials, and silverware. The metal’s unique properties made it essential in various fields, including electronics, medicine, and aerospace.

How did the price of silver in 1977 compare to other precious metals?

In 1977, the market share of silver compared to gold was relatively low. The price of silver fluctuated between $4.31 oz to $4.98 oz, while gold prices were much higher. Silver prices were recorded daily and were given in USD per troy ounce.

What were the most significant events or news stories that affected the silver market in 1977?

Market analysis suggests that the most significant events influencing the silver market in 1977 were the US dollar’s depreciation, inflation, and the Iranian Revolution. Investor sentiment was also impacted by the Hunt Brothers’ attempt to corner the silver market.