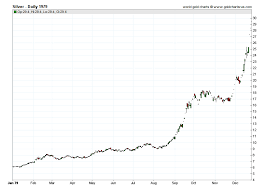

The price of silver has been a significant economic indicator for investors and analysts alike, with its fluctuations and increases having a significant impact on global markets. In 1979, silver prices experienced notable fluctuations, ranging from $5.94 oz to $9.19 oz, with significant increases in December reaching over $20 per ounce.

This period of volatility in silver prices is of interest to researchers and investors, as it provides valuable insights into the factors that drive the price of silver and the impact of geopolitical events on the market. To understand the factors that influenced silver prices during 1979, it is essential to examine the supply and demand dynamics during this period.

Additionally, geopolitical events such as the Soviet invasion of Afghanistan and the Iranian Revolution had a significant impact on silver prices as investors sought to hedge against inflation and geopolitical uncertainty. Therefore, studying historical trends in silver prices can provide valuable insights into the factors that drive the market and help investors make informed decisions about their investment strategies.

This article will examine the fluctuations and increases in silver prices during 1979, the factors that influenced prices, and the historical trends that can be gleaned from this period of financial volatility.

1979 Silver Prices

The pre-existing knowledge provides a wealth of information on the historical trends and fluctuations of silver prices, which can be useful for analyzing short-term fluctuations and long-term trends in the silver market. Daily data from 1968-2021 is available, including LBMA silver price fix history and worldwide forex silver markets trade. This data can aid investors in identifying investment opportunities and understanding the factors that affect silver prices.

One example of the historical trends in silver prices is the significant increase in prices from $6.08 oz on January 2, 1979, to over $20 per ounce in December 1979. This rise in prices can be attributed to various factors, such as supply and demand, geopolitical events, and economic indicators.

Understanding these trends and fluctuations can help investors make informed decisions and navigate the silver market.

Factors Affecting Prices

Factors affecting the value of precious metals are varied, with supply and demand being one of the most important determinants. For example, in the early 2000s, the demand for silver from the electronics industry increased dramatically due to the rise of smartphones and other mobile devices, driving up the price of silver. Similarly, the demand for silver in the solar energy industry has also increased significantly in recent years, contributing to the overall increase in the price of silver.

Other impactful events, such as geopolitical tensions, can also have an impact on the price of silver. For instance, any uncertainty in global financial markets can lead investors to seek safe-haven assets such as silver, resulting in an increase in its price. Additionally, the mining production of silver and the availability of recycled silver can also affect the supply side of the market, influencing its price. Understanding the supply and demand drivers and how they are affected by various events can help investors make informed decisions about investing in silver.

| Factors Affecting Silver Prices | Description | Examples | |

|---|---|---|---|

| Supply | The amount of silver available in the market | Mining production, recycled silver | |

| Demand | The amount of silver buyers are willing to purchase | Electronics industry, solar energy industry | |

| Geopolitical events | Events that impact the global financial markets and investor sentiment | Economic instability, trade wars | … can have a significant impact on the price of silver as investors may turn to precious metals as a safe-haven asset during times of uncertainty. |

Analyzing Historical Data

Analyzing past data can provide valuable insights into the behavior of precious metals in the market, including silver. Trends analysis of historical data can help investors and analysts understand the price volatility of silver and make informed decisions about their investments.

Silver prices have fluctuated throughout history, and analyzing trends in silver prices can help to identify potential opportunities for investors. Historical data shows that silver prices can be influenced by various economic, political, and social factors.

For example, in 1979, the price of silver increased significantly due to rising inflation rates and geopolitical tensions. By studying historical trends in silver prices, investors can gain a better understanding of the factors that impact the price of silver and use that knowledge to make informed investment decisions.

Frequently Asked Questions

What other precious metals were experiencing price fluctuations in 1979, and how did they compare to silver prices?

Comparison with gold and platinum reveals that all three precious metals experienced price fluctuations in 1979. However, silver prices saw the largest increases. These trends had an impact on investment strategies, particularly for those focused on precious metals commodities.

Were there any major events or news stories that impacted silver prices in 1979?

The silver market in 1979 was impacted by several events, including the Soviet invasion of Afghanistan and the Iranian Revolution. These geopolitical events caused increased demand for silver as a safe-haven asset. In comparison to other commodities, silver prices outperformed gold but lagged behind platinum and palladium.

How did the price of silver in 1979 compare to previous years, and what factors contributed to any significant differences?

Comparing silver prices: 1979 vs. 2021, the price of silver in 1979 ranged from $5.94 to $32.20 per ounce, with a significant increase in December. Factors that currently impact silver prices include supply and demand, economic health, and geopolitical events.

What industries or sectors were most impacted by changes in silver prices in 1979?

The silver market volatility in 1979 impacted various industries, including electronics, jewelry, and photography, due to their heavy reliance on silver. The fluctuating prices affected production costs, profit margins, and consumer demand, leading to significant changes in the market.

How did the global economic climate in 1979 influence silver prices, and were there any notable trends in different regions of the world?

Global silver production and investment strategies influenced silver prices in 1979. Notable trends include a significant increase in prices in December, with prices ranging from $8.78 to $32.20 per ounce, and daily prices useful for tracking short-term fluctuations.