The year 1990 marked a period of significant volatility in the prices of silver, with daily prices fluctuating between $3.96 oz and $5.21 oz. These fluctuations were influenced by a variety of factors, including global economic conditions, geopolitical events, currency exchange rates, inflation, interest rates, and mining production.

Understanding the factors that drove these price movements is crucial for investors and analysts seeking to make informed decisions about silver investments. This article, titled ‘Silver Prices in 1990: Fluctuations and Factors’, provides an overview of the daily silver prices from July 17 to December 31, 1990, and examines the various factors that influenced these price movements.

By analyzing historical data and contextualizing it within broader economic and political trends, this article aims to provide a comprehensive understanding of the complex factors that drove silver prices in 1990. It is important to note that all data provided is for educational purposes only, and readers should not rely solely on this information when making investment decisions.

Historical Context

In the context of the pre-existing knowledge about silver prices in 1990, it is important to consider the historical context that may have influenced the fluctuations in prices.

The silver market in 1990 was affected by a variety of factors, including global economic conditions and geopolitical events.

In particular, the Gulf War, which began in August of 1990, had a significant economic impact on the world, as it disrupted oil supplies and caused market uncertainty.

This uncertainty may have led investors to turn to safe-haven assets like silver, driving up demand and prices.

In addition to the Gulf War, other economic and geopolitical events may have affected the silver market in 1990.

These events included the dissolution of the Soviet Union, which created new economic opportunities and challenges, as well as the ongoing debt crisis in Latin America.

Overall, the historical context of 1990 suggests that the silver market was influenced by a complex array of factors, including global economic conditions, geopolitical events, and market speculation.

Understanding these factors is essential for understanding the fluctuations in silver prices during this period.

Factors Affecting Prices

Various economic, geopolitical, and industrial conditions played a significant role in shaping the trend of silver pricing in 1990.

The market analysis suggests that the prices were mainly influenced by the supply chain factors. The supply of silver was affected by the mining production, which was dependent on the availability of resources, labor, and equipment. The demand for silver was driven by industrial applications such as electronics, solar panels, and medical equipment, as well as jewelry and investment demand.

In addition, the prices were also affected by global economic conditions, inflation, interest rates, and currency exchange rates. The geopolitical events such as the Gulf War, the Soviet Union’s collapse, and the reunification of Germany also had an impact on the silver prices.

Market speculation and investor sentiment also played a role in driving the prices up or down. Overall, the fluctuations in silver prices in 1990 were a result of the complex interplay of various factors, and understanding these factors is essential for predicting future trends in the silver market.

Price Fluctuations and Trends

The intricate interplay of economic, geopolitical, and industrial conditions resulted in a dynamic silver market characterized by a rollercoaster ride of ups and downs in pricing trends.

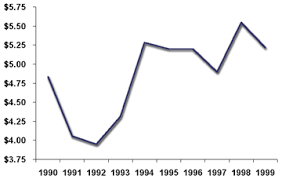

The year 1990 saw silver prices fluctuating between $3.96 and $5.21 per ounce, with the highest price reached on August 15 and the lowest on October 11. These fluctuations were influenced by a variety of factors such as supply and demand, global economic conditions, currency exchange rates, and market speculation.

One of the contributing factors to silver price fluctuations in 1990 was market volatility. The market was influenced by geopolitical events, such as the Gulf War, and economic conditions in major industrial countries, such as the United States and Japan.

Additionally, the demand for silver in the industrial sector, particularly in the electronics and photography industries, influenced pricing trends. The use of silver futures also played a role in market volatility, with speculators betting on the future price of silver.

Overall, the silver market in 1990 was characterized by a complex web of factors that contributed to the dynamic pricing trends seen throughout the year.

Frequently Asked Questions

What were the primary sources of demand for silver in 1990?

The primary sources of demand for silver in 1990 were investment and industrial demand. Investment demand was driven by the metal’s use as a safe-haven asset, while industrial demand was fueled by the electronics and photography industries.

How did the price of silver in 1990 compare to other precious metals?

When comparing silver to gold in 1990, silver averaged $4.54/oz while gold averaged $383.51/oz. Analysis of market trends for both metals showed that gold outperformed silver due to its safe-haven status during the Gulf War.

What impact did government policies have on the price of silver in 1990?

Government interventions and market speculation had an impact on the price of silver in 1990. However, the extent of their influence is difficult to quantify due to the numerous factors affecting silver prices, such as supply and demand, economic conditions, and currency exchange rates.

Were there any major mining strikes or supply disruptions that affected the price of silver in 1990?

There were no major mining strikes or supply disruptions reported in 1990 that had a significant impact on the price of silver. Other factors such as global economic conditions and market speculation played a more prominent role in price fluctuations.

How did the price of silver in 1990 compare to previous years, and what factors contributed to any changes in price?

Silver market trends in 1990 were influenced by global economic factors such as geopolitical events, currency exchange rates, inflation, and interest rates. The price of silver fluctuated throughout the year, reaching a high of $5.21 oz and a low of $3.96 oz.