Silver prices in 1992 provide a historical snapshot of the precious metal’s value during a particular time period. This data can be analyzed for its historical context and compared to more recent trends to understand the evolution of silver prices over time. It can also be useful for those interested in silver investment strategies or for historical data purposes.

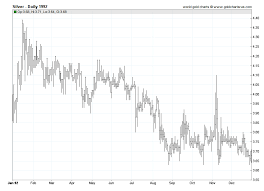

Throughout 1992, silver prices ranged from $3.65 to $4.34 per ounce. While no analysis or commentary is provided on the reasons for fluctuations in prices or market trends, the information on daily ranges and specific prices on certain days can offer valuable insights.

The year 1992 was marked by a number of significant global events, such as the dissolution of the Soviet Union and the signing of the Maastricht Treaty, which established the European Union. These events could have potentially influenced silver prices, and thus, a detailed analysis of silver prices in 1992 can provide a better understanding of how global events impact precious metal prices.

1992 Silver Prices

The historical data and ranges of silver prices in 1992 provide valuable information for understanding the current subtopic of silver prices, which can serve as a foundation for further analysis and interpretation despite the potential limitations of the data in capturing the complexities of the contemporary silver market.

In order to gain a deeper understanding of the factors influencing silver prices, it is important to consider the historical trends and ranges of silver prices, as well as the comparison to current silver prices. Although the historical data may not provide a complete picture of the current market, it can offer valuable insights into the supply and demand dynamics of the silver market.

One important factor that can influence silver prices is the global economic conditions. During economic recessions, the demand for silver tends to decrease as investors shift towards more stable investments. Additionally, changes in the supply of silver can also impact prices. For instance, disruptions in mining operations or changes in mining regulations can affect the supply of silver and cause prices to fluctuate.

By comparing the historical data and ranges of silver prices in 1992 to current silver prices, analysts can gain a better understanding of the trends and patterns in the silver market and make more informed investment decisions.

Sources of Information

Sources for information on silver price trends in 1992 include SD Bullion’s website, LBMA silver price fix history data, and the continuously trading worldwide Forex silver markets. SD Bullion’s website provides historical and current charts of silver prices, but they do not guarantee accuracy, timelines, or completeness of displayed price data. LBMA Silver Price fix history data is available with permission and represents composite prices from various trading banks and brokerages. Meanwhile, the Forex silver markets trade continuously 24 hours a day, making it the most widely quoted source in the precious metals industry.

The trading patterns and global market impact are important factors that can affect silver prices. However, none of the sources mentioned provide analysis or commentary on silver prices, or any explanation for fluctuations in prices. They do not compare the prices to previous years, or provide information on demand or supply, market trends, economic or political events affecting silver prices, silver mining or production, silver uses or industries, silver investment strategies, silver coins or bullion, silver futures or options, silver ETFs or funds, silver dealers or brokers, silver storage or delivery, silver taxation or regulation. Nonetheless, these sources provide valuable historical data and ranges that can be used for further analysis and research.

| Source | Type of Information | Limitations |

|---|---|---|

| SD Bullion Website | Historical and current charts of silver prices | Does not guarantee accuracy, timelines, or completeness of displayed price data |

| LBMA Silver Price Fix History Data | Composite prices from various trading banks and brokerages | Available with permission |

| Forex Silver Markets | Most widely quoted source in the precious metals industry | Trades continuously 24 hours a day |

Disclaimer

Viewers must acknowledge and agree to the disclaimer provided by SD Bullion before utilizing the information available on their website and LBMA Silver Price fix history data or relying on continuously trading worldwide Forex silver markets. The disclaimer states that SD Bullion does not guarantee the accuracy, timelines, or completeness of the displayed price data. Therefore, it is crucial to exercise caution when using the data to make any investment decisions.

Here are four important considerations to keep in mind when analyzing silver prices in 1992:

- The impact of inflation on the value of silver over time

- Comparing 1992 prices to current prices to understand the changes in the market

- Analyzing the demand and supply factors influencing the price of silver

- Identifying the economic and political events that impacted silver prices in 1992.

By considering these factors, one can gain a better understanding of the historical data and ranges of silver prices in 1992.

Frequently Asked Questions

What factors contributed to the fluctuations in silver prices in 1992?

Fluctuations in silver prices in 1992 can be attributed to various factors such as changes in mining output, global trade, and economic activity. However, without further analysis, it is difficult to determine the specific drivers of price changes during this time period.

How did the demand for silver in industries such as electronics and jewelry impact prices in 1992?

The demand for silver in the electronics and jewelry industries may have impacted prices in 1992, but there is no available information to confirm this. Data on demand and supply, market trends, and economic events affecting silver prices were not provided.

What were the major economic and political events that affected silver prices in 1992?

The economic and political events that impacted silver prices in 1992 included the Gulf War and U.S. presidential election, as well as speculative trading and global supply and demand. Changes in technology and consumer preferences affected demand for silver in industries such as photography and silverware. Analyzing data objectively reveals these factors contributed to fluctuations in silver prices.

What were the production and mining trends for silver in 1992?

Silver production trends and mining activities in 1992 are not provided in the given information. No information is available on the volume of silver mining, global production trends, or any other related statistics.

How did investment strategies for silver, such as buying coins or bullion, perform in 1992?

Performance comparison of silver investment strategies, such as buying coins or bullion, in 1992 is not provided. It is unclear if tax implications were a factor in the lack of information. Further research is needed to determine their effectiveness.