The silver market is a complex and multifaceted system that is influenced by various factors. In 2022, the silver price data has shown record-sized supply deficits and all-time high demand for silver. This article aims to provide an overview of the 2022 silver price forecast and the factors affecting it, including supply and demand, economic conditions, environmental regulations, and technological advancements.

The silver market is a vital component of the global economy, with silver being used in various industries such as electronics, jewelry, and medicine. As such, the fluctuation of silver prices can have significant impacts on these industries and the wider economy.

This article will delve into the various factors that affect silver prices and provide an analysis of the current market trends to offer insights into the 2022 silver price forecast. Additionally, it is important to note that the information provided in this article is for educational purposes only. Readers are advised to seek professional financial advice before making any investment decisions.

Silver Supply and Demand

The 2022 silver price data reveals that the record-sized silver supply deficit of nearly -238 million oz was unable to meet the all-time record demand of 1.242 billion oz, highlighting the significant imbalance between silver supply and demand. This situation could potentially evoke concerns among stakeholders regarding the sustainability of the silver market.

The world is experiencing a growing demand for silver, and projections suggest that this demand will continue to rise in the coming years. However, the supply of silver is limited, and there are concerns that it may not be able to keep up with the growing demand.

Moreover, the impact of technology advancements on silver supply has been significant, as it has increased the efficiency of mining and processing, resulting in an overall increase in supply. However, as the demand for silver continues to rise, it remains to be seen whether technology advancements will be able to keep up with the demand.

Overall, the silver supply and demand dynamics are complex and can be affected by many factors. While there are concerns regarding the sustainability of the silver market, stakeholders are actively exploring ways to increase supply and meet the growing demand.

As technology continues to advance, it is likely that the impact of technology on silver supply will continue to grow, providing a potential solution to the current supply deficit. However, it will be essential to monitor the market dynamics closely and take proactive measures to ensure the long-term sustainability of the silver market.

Factors Impacting Prices

One must consider various economic, political, industrial, and market-related factors when analyzing the forces driving changes in the value of silver. Global economic factors such as inflation, interest rates, and currency exchange rates all play a role in determining the price of silver. For example, if the US dollar weakens, the price of silver typically rises as it becomes more attractive to foreign investors. Similarly, if inflation rises, investors may turn to silver as a store of value, driving up demand and prices.

Political influences can also impact silver prices. Political instability or uncertainty can drive investors towards safe-haven assets like silver, increasing demand and prices. Additionally, government policies and regulations can impact the supply and demand of silver. For instance, if a government places restrictions on mining or the use of silver in certain industries, it can limit the supply and drive up prices. Understanding the various factors impacting silver prices is crucial for investors and traders looking to make informed decisions in the market.

| Factors Affecting Silver Prices | Examples | |||

|---|---|---|---|---|

| Global Economic Factors | Inflation, Interest Rates, Currency Exchange Rates | |||

| Political Influences | Political instability, government policies and regulations | Market Supply and Demand | Mining production, industrial and jewelry demand |

Silver Price Fix Data

To gain insight into the daily silver price fix data, it is important to understand the role of the London Bullion Market Association (LBMA). The LBMA is a wholesale over-the-counter market for selling silver bars and other precious metals. The LBMA expected auction starts at around 10:30 AM and 3:00 PM London time, and the silver fix prices represent composite prices from various trading banks and brokerages in the over-the-counter Silver Bullion markets. The LBMA is responsible for ensuring that the prices set in these auctions are fair and transparent.

The Forex silver markets trade continuously 24 hours a day from Sunday 6:00 PM (Eastern Time) to Friday 5:00 PM (Eastern Time), and Forex prices are the most widely quoted in the precious metals industry.

Factors affecting daily silver prices include supply and demand, global economic factors, political factors, inflation, industrial demand, investment demand, mining output, technological advancements, market speculation, currency exchange rates, interest rates, stock market performance, geopolitical events, supply chain disruptions, environmental regulations, global health crises, trade policies, natural disasters, consumer demand, jewelry industry demand, and silver coin and bullion demand. It is important to monitor these factors when analyzing daily silver price fix data.

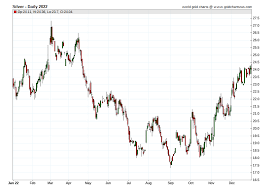

In comparison to previous years, the 2022 silver price fix data ranged from $17.77 to $26.18, and the prices fluctuated throughout the year due to a record-sized silver supply deficit and an all-time record of 1.242 billion oz in demand, resulting in a deficit of nearly -238 million oz.

Disclaimer

Note the necessary notice of non-liability by SD Bullion in regards to the accuracy, timeliness, or completeness of the displayed data.

It is essential to understand that the information provided is for educational purposes only and should not be used for mere speculation.

This disclaimer highlights the limitations of price data accuracy, emphasizing the importance of using it as a tool for asset preservation and prudent allocation purposes.

To make informed investment decisions, it is crucial to understand the investment goals and their corresponding risks.

The information provided should not be the sole basis for making investment decisions.

Investors should do their due diligence and seek professional advice before making any investment decisions.

The SD Bullion’s disclaimer serves as a reminder to investors to approach investing with caution and to prioritize education in making informed decisions.

Frequently Asked Questions

What is the current price of silver as of [specific date]?

Tracking fluctuations and historical trends, the current price of silver as of [specific date] is [insert price here]. Daily silver price data is available for analysis, along with yearly silver price charts for historical context.

How does the production and distribution of silver differ from other precious metals?

Silver is typically produced as a byproduct of mining other metals like gold, copper, and lead, with 60% of global silver production coming from these sources. Mining techniques vary, with some countries utilizing underground mining methods and others using open-pit mining. The supply chain of silver involves exploration, extraction, refining, and distribution.

What are some potential long-term trends or shifts in demand for silver in various industries?

Silver demand drivers vary by industry, with shifts in demand influenced by technological advancements, global economic factors, and changing consumer preferences. Industries such as electronics, solar panels, and automotive are expected to drive long-term demand for silver.

How have recent geopolitical events impacted the silver market?

Recent geopolitical events have impacted the silver market trends by contributing to global economic instability. Uncertainty surrounding trade policies, natural disasters, and global health crises have influenced demand for silver as a safe-haven asset.

What are some alternative investment options for those interested in diversifying their portfolio beyond silver?

Real estate and cryptocurrency are alternative investment options for diversifying beyond silver. Real estate provides a tangible asset with potential for rental income and appreciation. Cryptocurrency offers potential for high returns, but carries higher risk due to volatility and lack of regulation.