The price of silver is known for its volatility and is influenced by a wide range of factors. Understanding these factors and trends that impact silver prices can be valuable for investors and traders looking to profit from the fluctuations in the market.

This article aims to explore the various factors and trends that impact the price of silver, using daily silver price data for the year 2019 as a case study. In this article, we will examine the key drivers of silver prices, including global economic conditions, supply and demand, interest rates, geopolitical events, and currency values.

We will analyze the daily silver price data for 2019 to identify trends and patterns and explore how these factors influenced silver prices throughout the year. Additionally, we will discuss the implications of these trends and what they mean for investors and those interested in preserving their wealth through silver investments.

By delving into the various factors and trends that impact silver prices, this article aims to provide a comprehensive understanding of how the silver market operates and how investors can navigate this complex landscape.

What Affects Silver Prices?

The price of silver is subject to various factors that can influence its fluctuation. A significant determinant is global economic conditions, as economic growth and stability can increase industrial and investment demand for silver, thus driving up prices.

Additionally, supply and demand factors can affect the price of silver, as shifts in production and consumption can lead to changes in silver supply and demand, affecting prices accordingly.

Moreover, changes in the value of fiat currencies can impact the price of silver, as a weakening of currency can increase the demand for silver as a store of value. Interest rate fluctuations can also influence silver prices, as higher interest rates can strengthen the value of fiat currencies, reducing the demand for silver as a safe haven investment.

Other factors that can affect the price of silver include geopolitical events, shifts in the stock market, and changes in the prices of other commodities. Understanding these factors is crucial for silver price forecasting and correlation with other commodities.

Silver Market Information

Foreign exchange markets trade silver continuously 24 hours a day, with prices quoted widely in the precious metals industry. The most commonly traded silver products include silver futures contracts, silver options contracts, silver mining stocks, and silver streaming stocks.

The fluctuation in silver prices is due to various factors, including global economic conditions, supply and demand, changes in fiat currency value, geopolitical events, and changes in interest rates.

Silver market trends are also influenced by global demand, which is driven by various industries such as electronics, jewelry, medicine, and investment. The increasing demand for silver in the electronics industry is due to its high conductivity and durability, whereas in the jewelry industry, it is popular for its aesthetic appeal.

Moreover, silver has been seen as a store of value and investment for centuries, which has led to an increase in demand for silver coins, bars, and rounds. The demand for silver is expected to continue to grow in the future, leading to fluctuating prices and increased market volatility.

Silver Investing and Preservation

Investors and individuals seeking to preserve their assets may consider diversifying their portfolio with physical precious metal bullion products, including silver. Silver has been used as a store of value and investment for centuries, and its value has been influenced by various market trends.

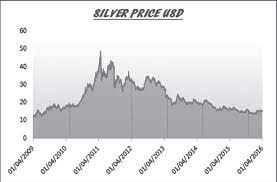

In recent years, silver prices have been affected by factors such as changes in global economic conditions, supply and demand, geopolitical events, interest rates, and changes in fiat currencies.

Investing in silver can be a strategy for individuals looking to diversify their portfolio and hedge against inflation. Silver can be purchased in various forms, including coins, bars, and rounds, and can be stored in secure locations or with providers offering storage options.

Market trends and analysis can provide insight into potential investment opportunities and risks. However, it is important to approach silver investing with caution and not rely solely on speculation or opinions. Seeking professional advice and conducting thorough research can help individuals make informed investment decisions.

Recent News Coverage

Recent news coverage has brought to light allegations of criminality within JPMorgan’s precious metals trading desk. It has been reported that several traders at the bank have been charged with market manipulation and racketeering, with prosecutors alleging that they engaged in a scheme to manipulate the price of precious metals, including silver, for several years. While JPMorgan has denied any wrongdoing, the allegations have raised concerns about the integrity of the precious metals market and the role of large banks in pricing these commodities.

Furthermore, the COVID-19 pandemic has had a significant impact on silver prices in recent months. As global economic activity slowed down and investors sought safe-haven assets, silver prices initially rose, reaching a seven-year high in August 2020. However, as the pandemic continued to spread and uncertainty around economic recovery persisted, silver prices have since fluctuated.

The ongoing pandemic and its effects on global trade and economic growth are likely to continue to impact silver prices in the near future.

Frequently Asked Questions

How does the price of silver compare to other precious metals like gold and platinum?

The gold-silver ratio is used to compare the value of gold to silver. As of 2019, the gold-silver ratio was around 85-90:1, indicating that gold was significantly more valuable than silver. There is no evidence of silver market saturation.

What is the historical significance of silver as a currency and how does that impact its value today?

Silver has a long historical significance as a form of currency and store of value. Its monetary value is impacted by various factors, including supply and demand, global economic conditions, and changes in the value of fiat currencies, among others.

Are there any new technologies or industries emerging that could significantly impact the demand for silver?

New industries such as solar panels, electric vehicles, and 5G technology are increasing demand for silver. Investment options like silver ETFs and coins are also contributing to demand.

How do political events and policies, both domestic and international, affect the price of silver?

It is quite ironic that despite silver being a safe haven asset, political instability and economic sanctions can actually cause its prices to fluctuate. Impartial analysis of data suggests that such events can impact the supply and demand of silver, leading to price changes.

What is the long-term outlook for the price of silver and how can investors best position themselves to take advantage of potential fluctuations?

Silver market analysis suggests that the long-term outlook for silver prices is positive due to increasing demand from industries such as electronics and solar power. Investment strategies for silver price fluctuations include diversifying portfolios with physical silver and monitoring global economic conditions.