Do you ever wonder about the current price of silver per gram? Well, you’re in luck!

In this article, we will delve into the objective, analytical, and data-driven analysis of the price of silver. By exploring historical trends, factors affecting the price, and current market analysis, we aim to provide you with valuable insights into the world of silver investment.

So, sit back, relax, and let’s uncover the secrets of silver’s worth!

Key Takeaways

- Silver prices reached a peak of around $48 per ounce in April 2011 during a notable upswing from 2005 to 2011.

- Factors such as increased investor demand, economic uncertainty, and the growing popularity of silver as an investment asset drove this surge.

- Since then, silver prices have been more volatile, experiencing both peaks and troughs.

- Monitoring global economic conditions, geopolitical tensions, and supply-demand dynamics is crucial for making informed decisions in the silver market.

Historical Trends of Silver Prices

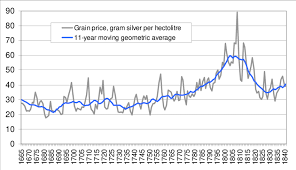

You’ll notice that silver prices have fluctuated significantly over the years. Analyzing historical trends can provide valuable insights into the patterns and factors influencing these fluctuations.

Looking back at the data, it’s evident that silver prices experienced a notable upswing from 2005 to 2011, reaching a peak of around $48 per ounce in April 2011. This surge was driven by factors such as increased investor demand, economic uncertainty, and the growing popularity of silver as an investment asset.

However, since then, silver prices have been more volatile, experiencing both peaks and troughs. Various factors, including global economic conditions, geopolitical tensions, and supply-demand dynamics, continue to influence silver prices.

It’s crucial to monitor these trends closely to make informed decisions in the silver market.

Factors Affecting the Price of Silver

If you’re wondering why the cost of silver fluctuates, it’s influenced by various factors. Here are four key factors that affect the price of silver:

- Supply and demand: Like any commodity, the price of silver is heavily influenced by the balance between its supply and demand in the market. If the demand for silver exceeds the available supply, prices tend to rise.

- Economic indicators: Silver prices often mirror the overall health of the economy. When economic indicators such as GDP growth, inflation, or unemployment rates are positive, silver prices tend to increase.

- Currency fluctuations: The value of silver is linked to the currency it’s traded in. If there are fluctuations in the value of the currency, it can impact the price of silver. For example, a weaker currency can make silver more expensive for buyers.

- Geopolitical factors: Geopolitical events, such as political instability or trade disputes, can impact the price of silver. Uncertainty in the global market can lead investors to seek safe-haven assets like silver, driving up its price.

These factors, along with other market forces, contribute to the constantly changing price of silver. Understanding these influences can help individuals make informed decisions when buying or selling silver.

Current Market Analysis of Silver Prices

In today’s market, silver prices are influenced by a variety of factors. These include supply and demand dynamics, economic indicators, currency fluctuations, and geopolitical events.

The supply and demand dynamics play a crucial role in determining the price of silver. When the supply is low and demand is high, the price tends to rise. Conversely, when the supply is high and demand is low, the price tends to fall.

Economic indicators, such as inflation rates and interest rates, also impact silver prices. During periods of high inflation, investors tend to flock towards silver as a hedge against currency devaluation. Similarly, changes in interest rates can affect the attractiveness of silver as an investment option.

Currency fluctuations and geopolitical events can create volatility in the silver market. For example, political tensions or economic crises can drive up the price of silver as investors seek safe-haven assets.

Considering these factors, it’s important to analyze whether investing in silver is worth it.

Investing in Silver: Is It Worth It

Investing in silver can be a profitable decision, especially when considering factors like supply and demand, economic indicators, and geopolitical events. Here are four key reasons why investing in silver is worth considering:

- Supply and Demand: The demand for silver is on the rise due to its various industrial applications, including electronics and solar power. At the same time, the supply of silver is limited, making it a valuable commodity.

- Economic Indicators: Silver prices often move in tandem with the global economy. During periods of economic uncertainty, investors tend to flock towards silver as a safe-haven asset, driving up its price.

- Geopolitical Events: Political tensions and conflicts can have a significant impact on silver prices. When geopolitical events create uncertainty in the markets, investors turn to silver as a store of value, leading to price increases.

- Inflation Hedge: Silver has historically been viewed as a hedge against inflation. As the value of fiat currencies erodes over time, silver retains its purchasing power, making it an attractive investment option.

Considering these factors, investing in silver can be a prudent choice for those looking to diversify their portfolios and potentially reap significant returns.

Silver Vs. Gold: a Comparison of Precious Metal Prices

When it comes to precious metals, gold tends to be more expensive than silver. However, that doesn’t mean silver doesn’t have its own value. In fact, investing in silver can be a smart move for many investors. Let’s compare the prices of these two precious metals:

| Metal | Price per gram (USD) | Price per ounce (USD) |

|---|---|---|

| Gold | $55.72 | $1,733.28 |

| Silver | $0.79 | $24.65 |

As you can see from the table, the price of gold per gram is significantly higher than that of silver. Gold is often considered a safe haven investment, especially during times of economic uncertainty. On the other hand, silver is more affordable and can be a good option for investors looking for potential growth. It’s important to consider your investment goals and risk tolerance when deciding between these two precious metals.